Description

How To Play Queen of Hearts

Once a ticket is drawn, the card on the Board that corresponds to the number selected on the ticket will be turned over. If the Queen of Hearts is turned over, the winning ticket holder will receive 50% of the pot. Other payouts include:

- Any Queen other than the Queen of Hearts pays $250

- The Ace of Spades will pay $500

- A Joker will pay 10% of the pot and the game will reset, with the remaining pot being rolled over to a new board.

If the card flipped is any card other than the Queen of Hearts or a Joker, all tickets will be cleared, the pot continues to build and new tickets will be sold for the following weekly drawing.

Queen of Hearts Rules and FAQ

Tickets are $2 each with no limit on the number of tickets that can be purchased. There is no limit on the number of tickets that can be sold.

Commonwealth Causes is a non-profit 501c3 – Gaming License # ORG0002761

Prizes MUST be claimed within 30 days after the day the winning ticket is pulled. Unclaimed prizes will be donated back to Commonwealth Causes.

Raffle drawings are held and live-streamed every Thursday night at 8:00pm ET HERE. Also, feel free to watch the live drawings at @kycauses on Facebook, Youtube, Twitter, and Instagram.

WHAT IS A QUEEN OF HEARTS RAFFLE?

The Queen of Hearts is a 50/50 raffle, with 50% of the pot going to the winner and 50% benefiting Commonwealth Causes, a Kentucky based 501(c)(3) nonprofit organization, gaming license #ORG0002761.

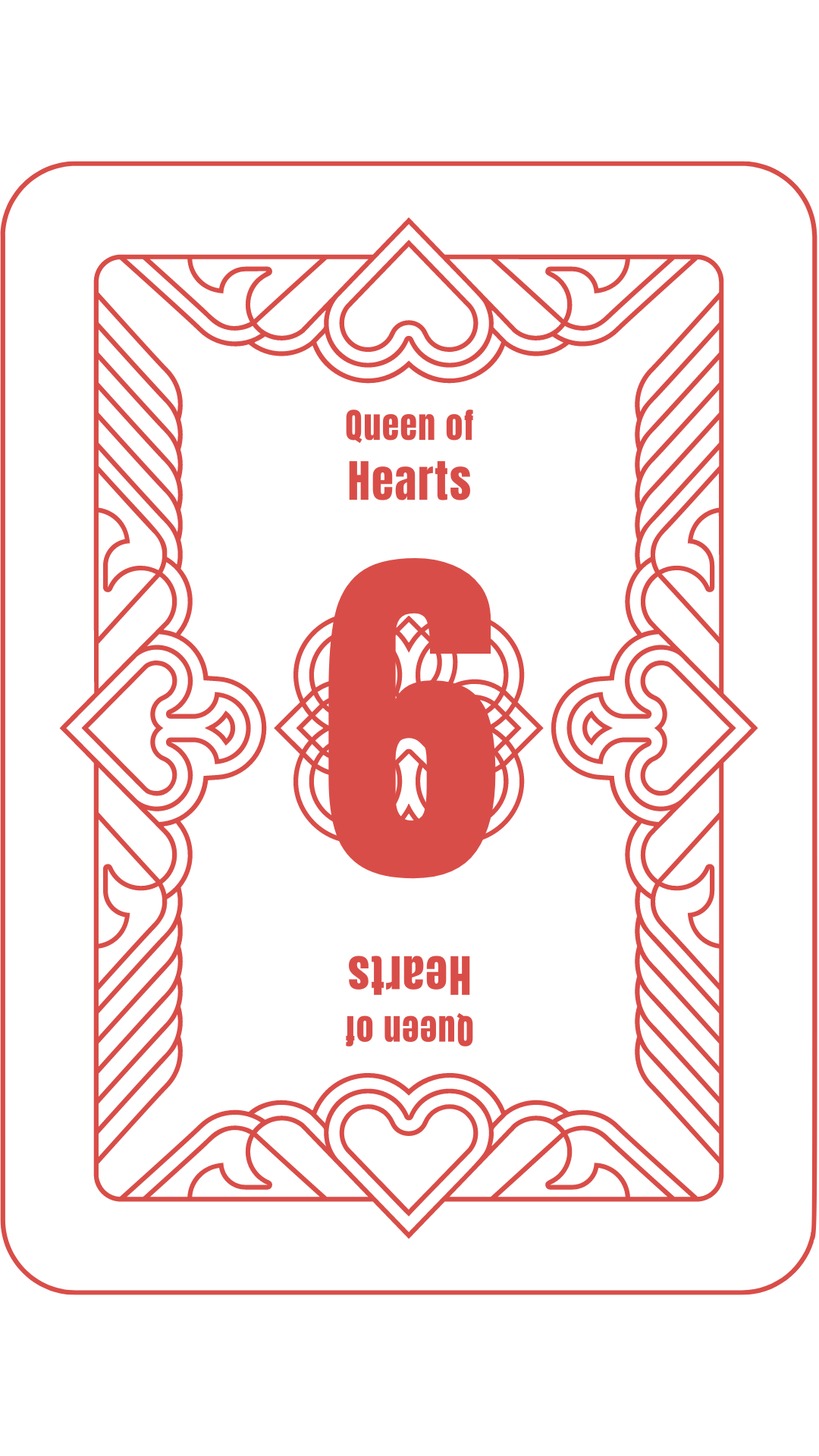

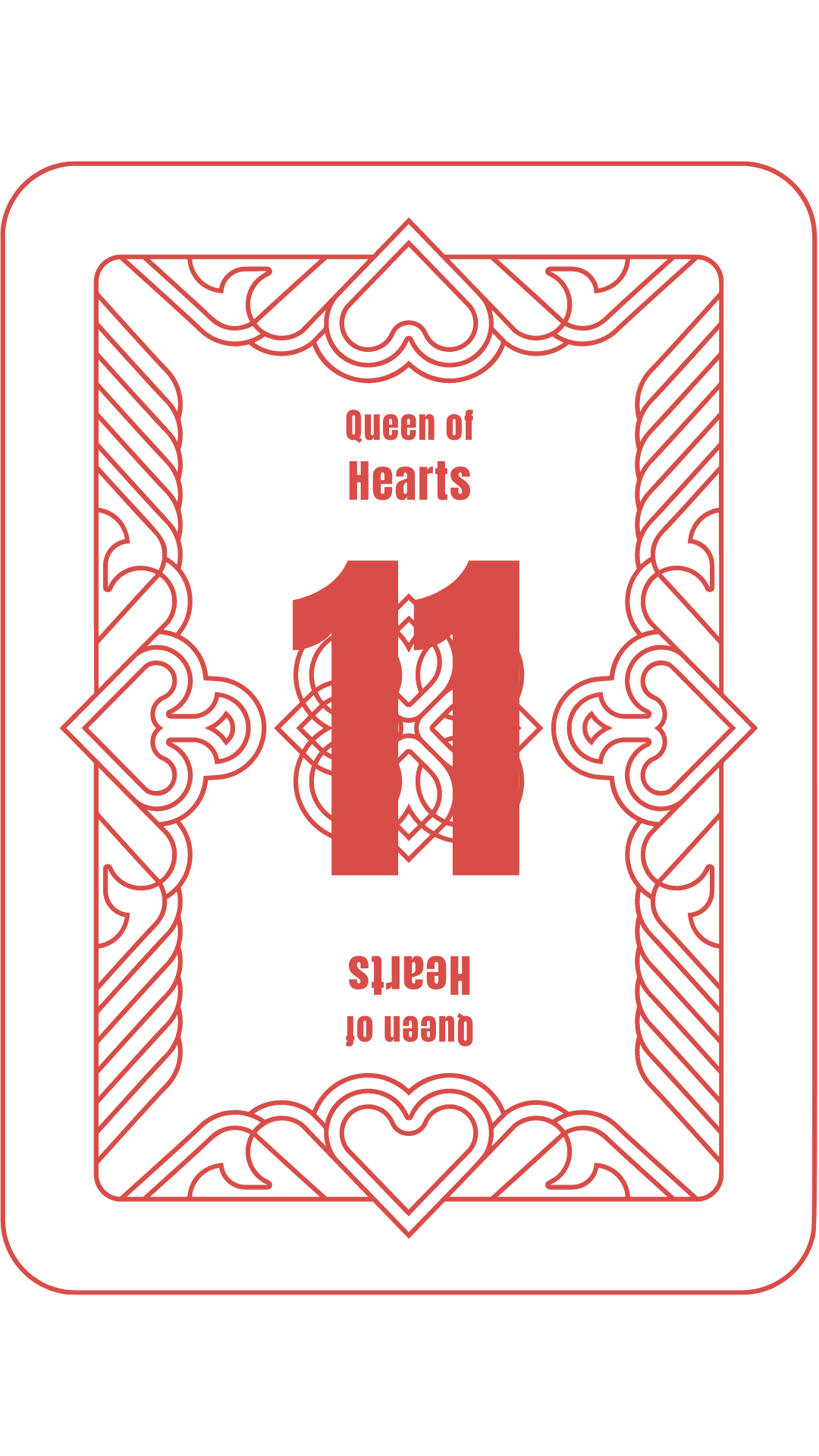

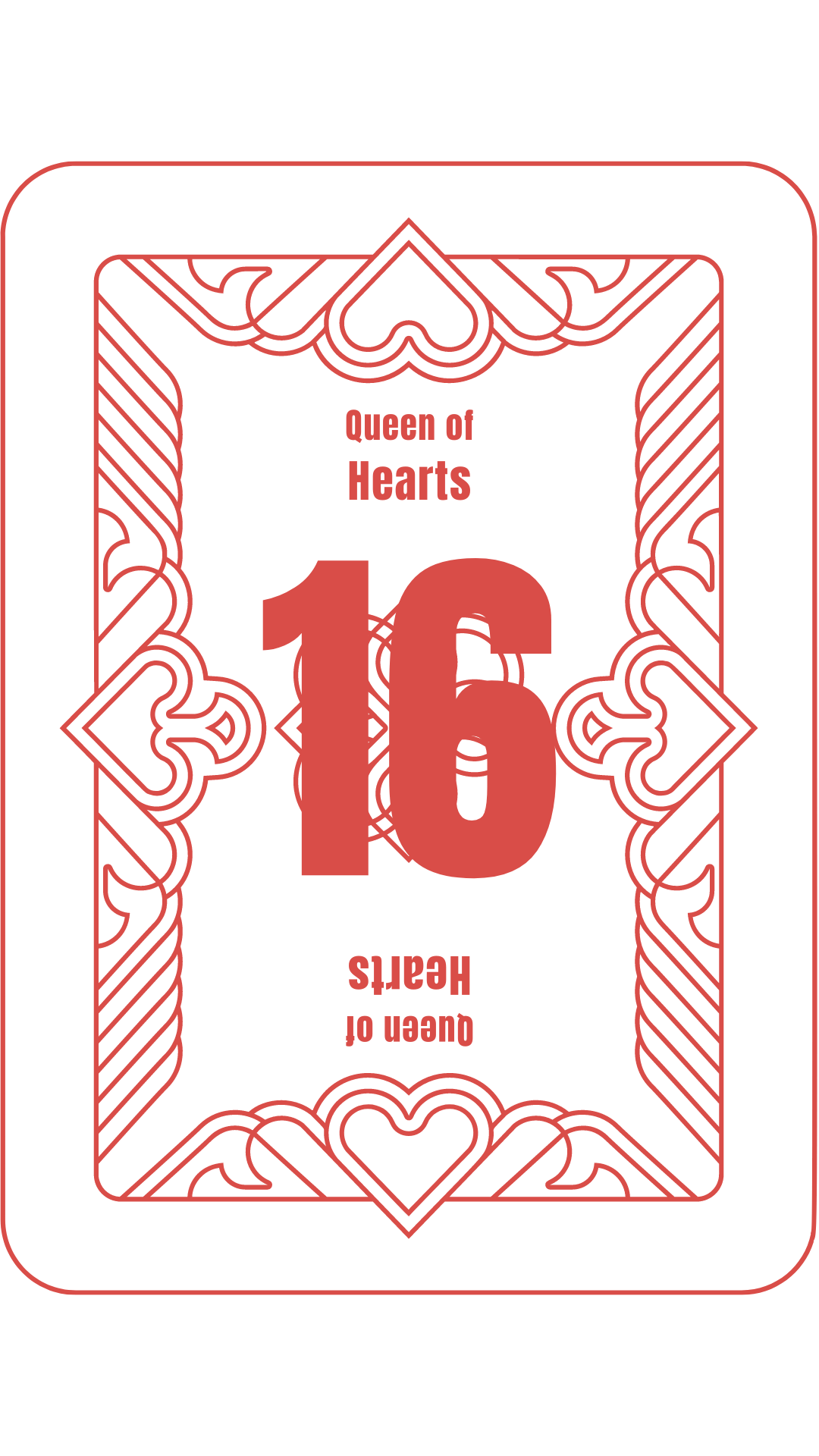

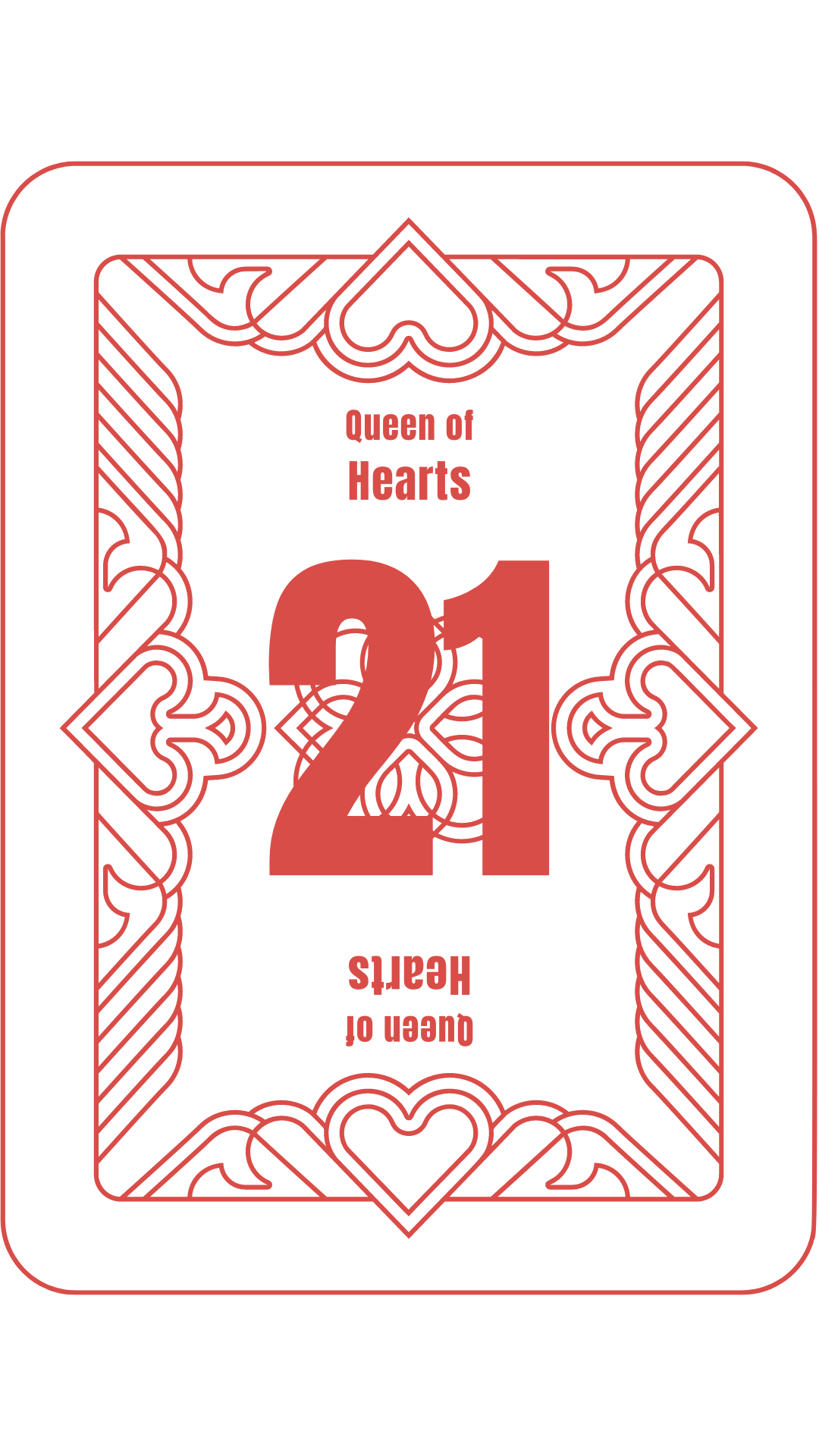

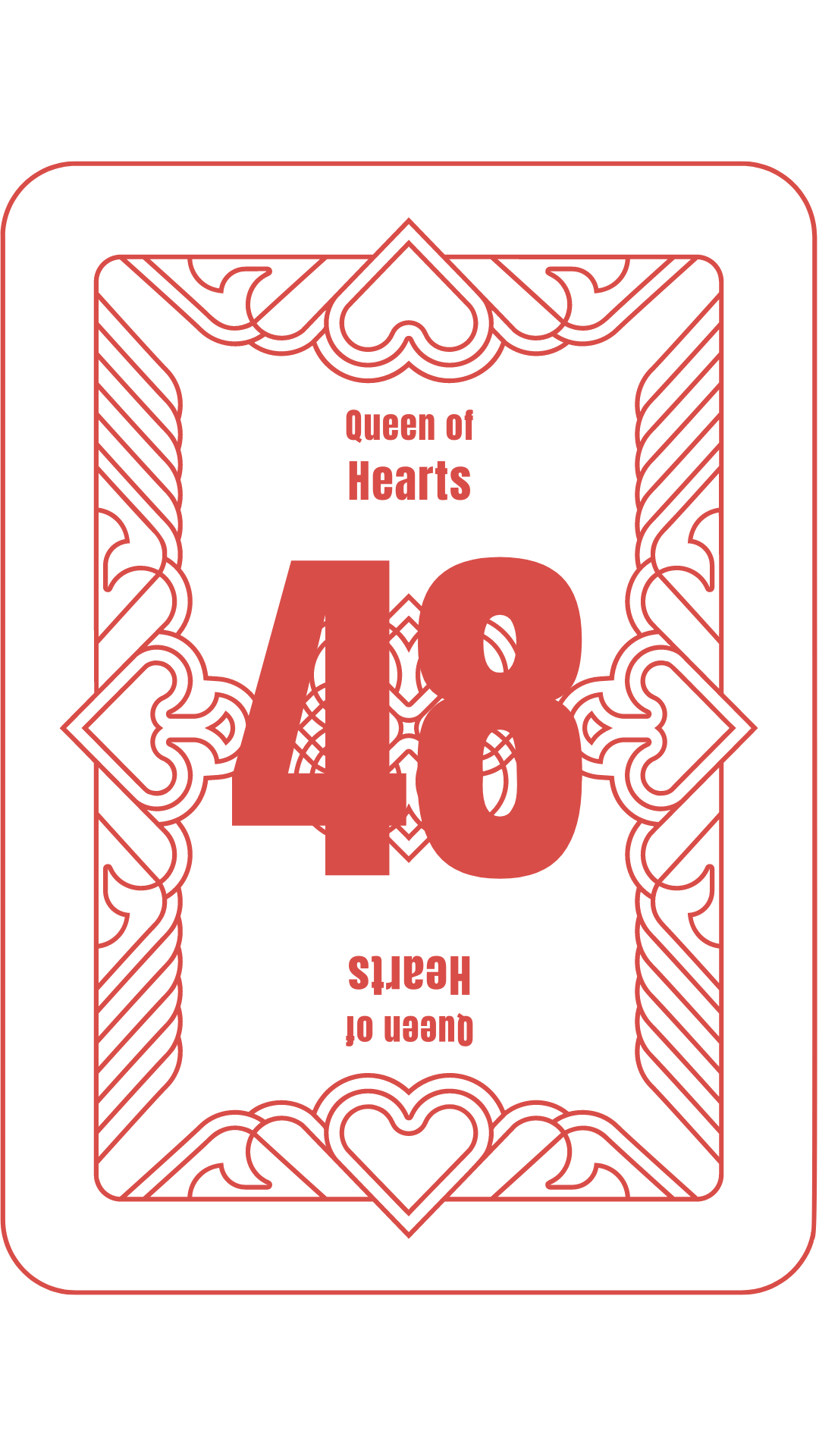

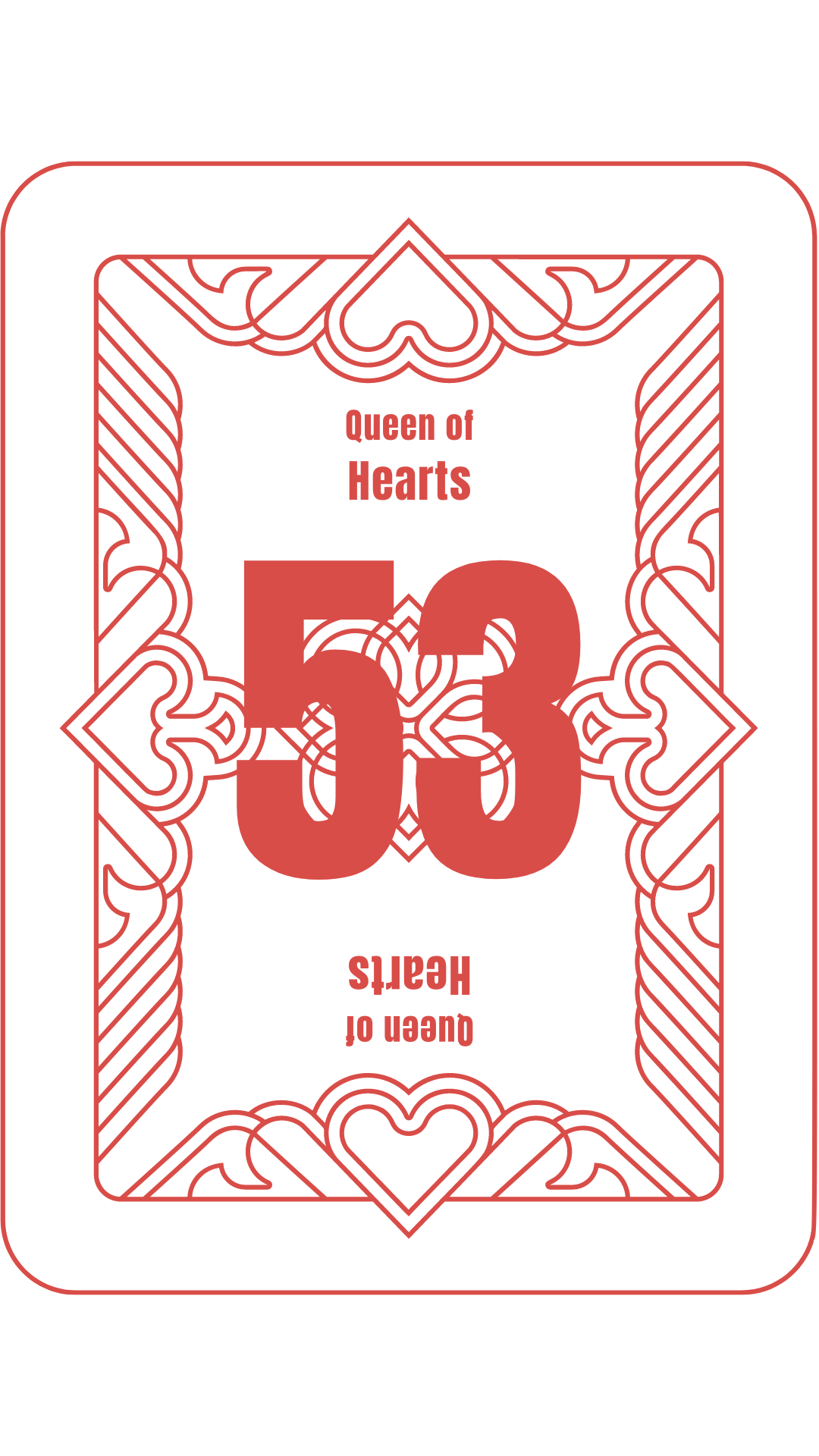

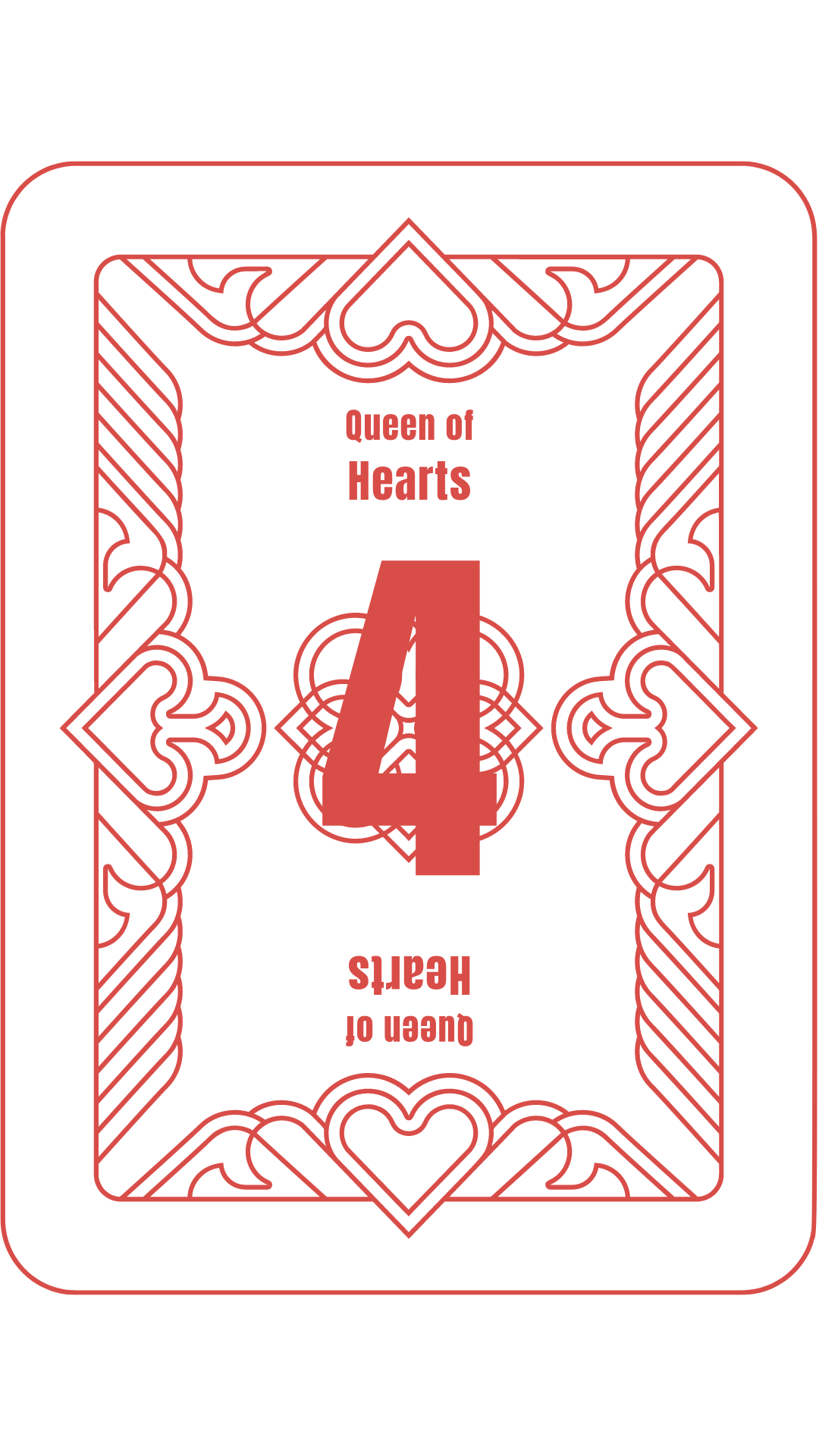

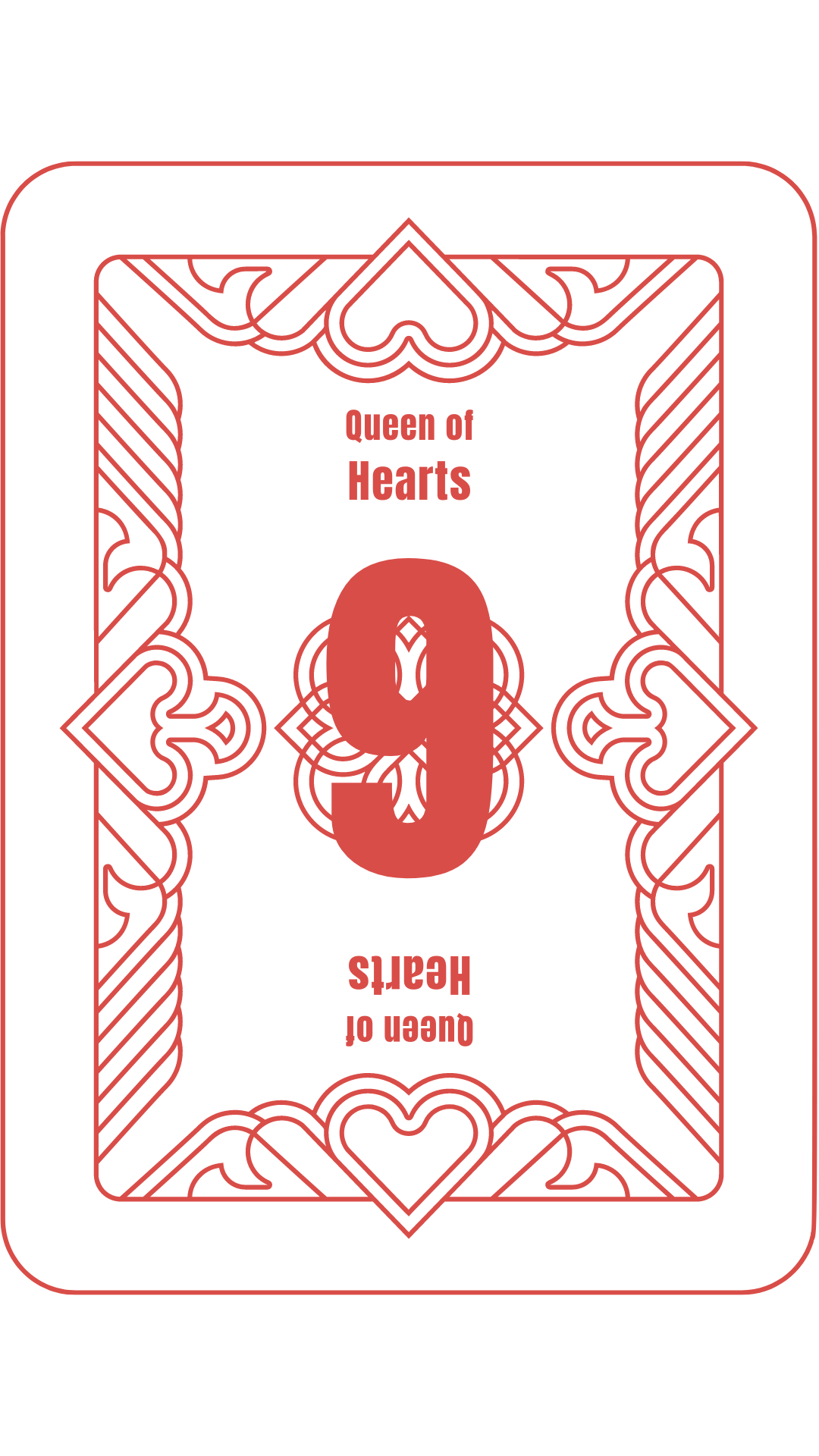

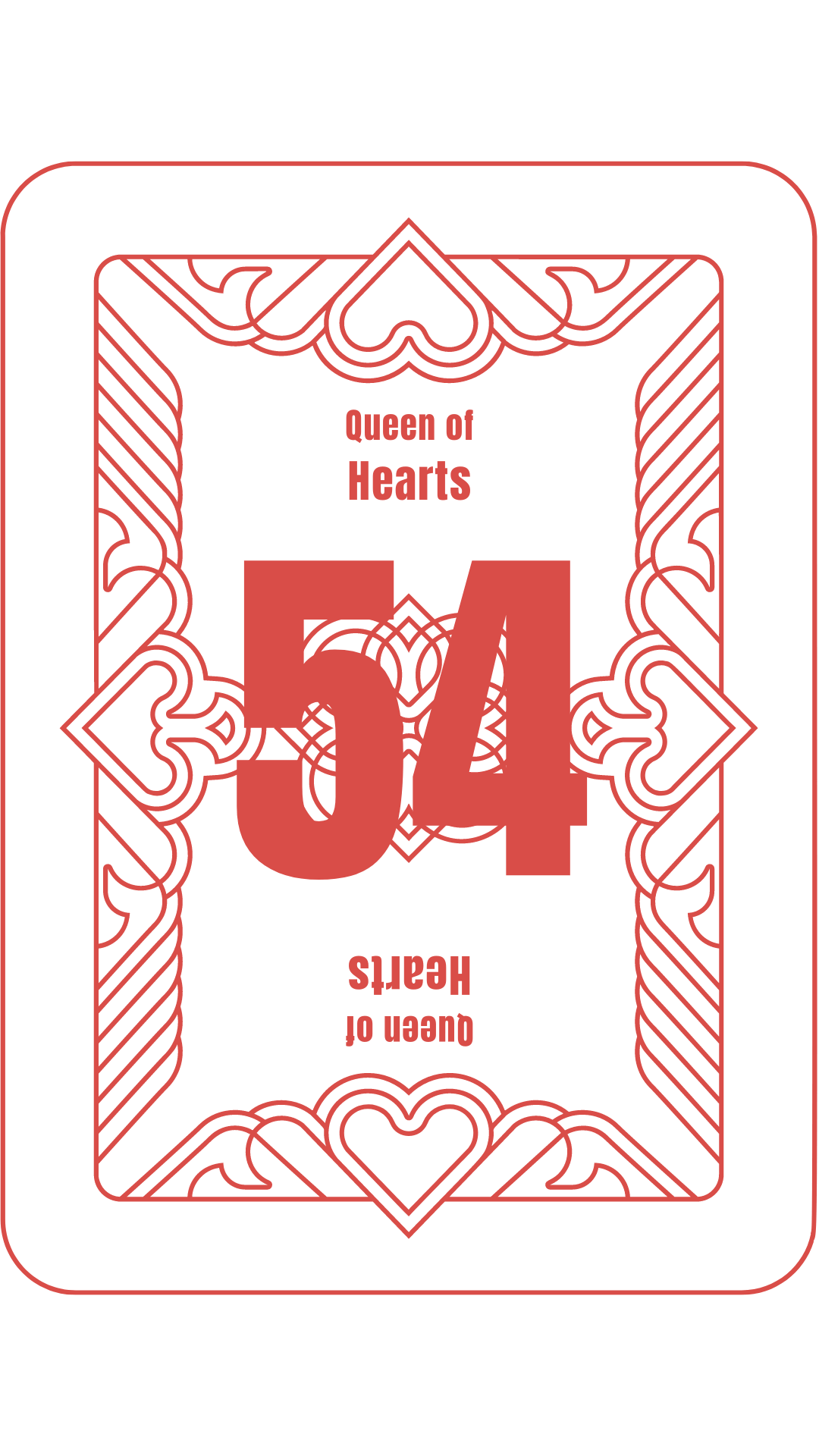

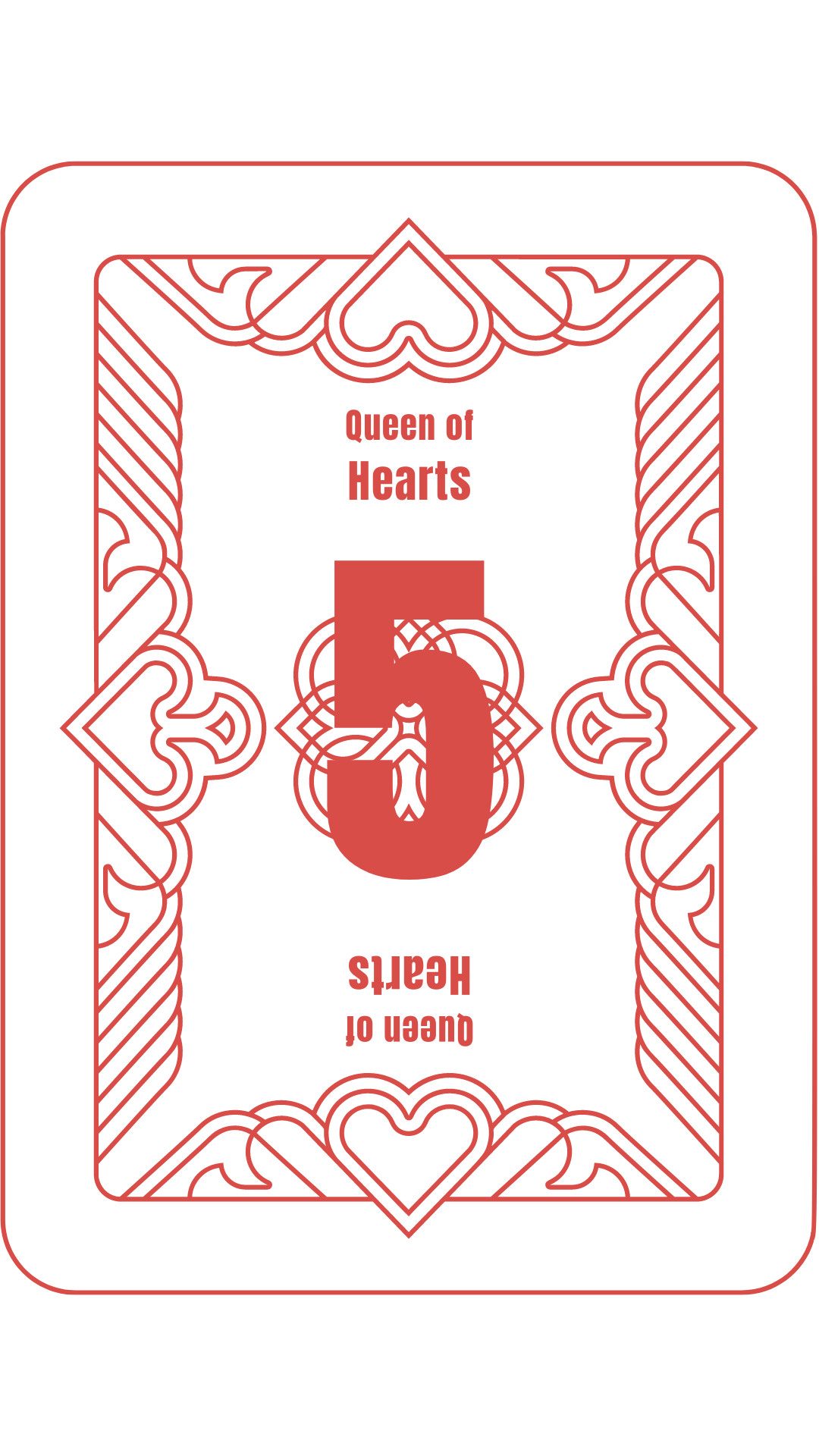

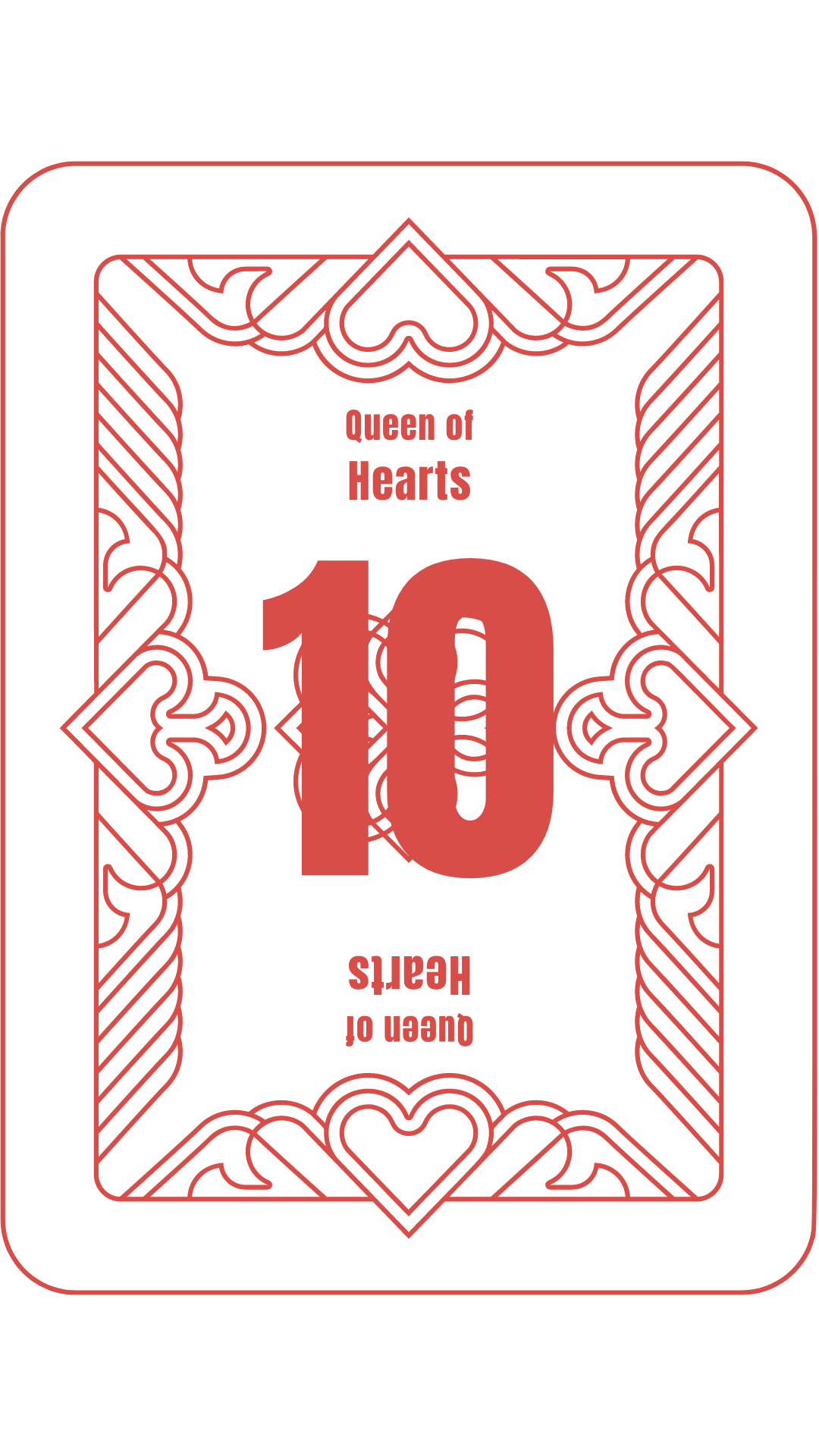

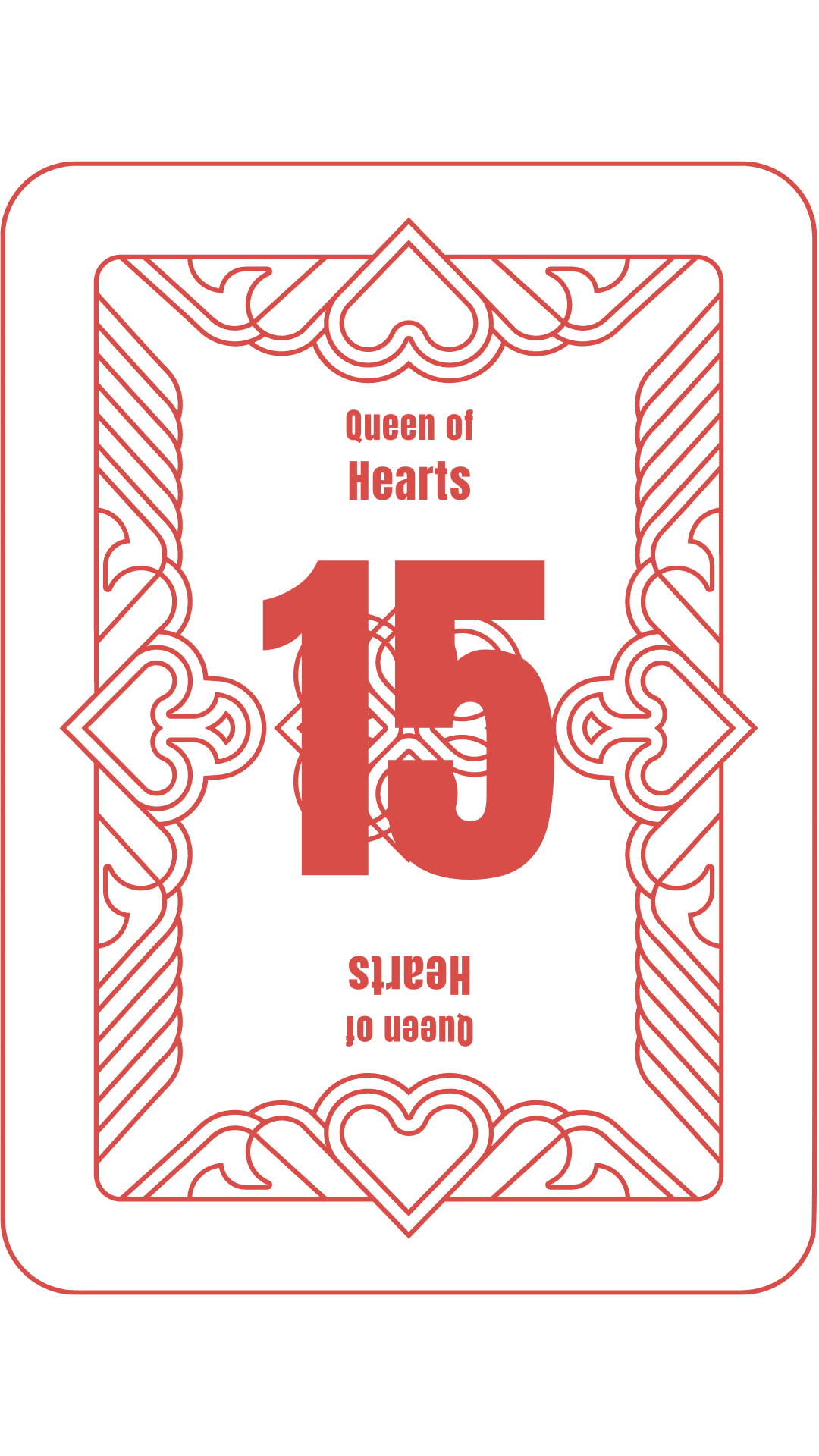

The Board will consist of a full standard deck of cards plus 2 jokers. Each card will be numbered 1 – 54. Each player will choose a number at the time a ticket is purchased.

Commonwealth Causes has funded the initial pot with $10,000. The pot will remain at $10,000 until the first 5,000 tickets have been sold.

WHAT ARE THE ELIGIBILITY RULES?

All participants must be at least 18 years of age or older to play.

All participants must hold a valid US Social Security card to claim a prize.

All prizes over $599 will be paid by check and the recipient will be issued a W-2G.

For prizes over $4,999, Commonwealth Causes will withhold 24% in Federal taxes and 5% in Kentucky taxes per Federal and State requirements.

Prize winners that fail to comply with eligibility rules will forfeit the prize.

The Board